We help business owners maximize profits by providing entrepreneurs with unprecedented clarity using, data, AI, and financial techniques —in 90 days or we work for free.

We help business owners maximize profits by providing entrepreneurs with unprecedented clarity using, data, AI, and financial techniques—in 90 days or we work for free.

AI tools & financial advice empower you to make scalable, data-driven decisions.

AI tools & financial advice empower you to make scalable, data-driven decisions.

FSA isn’t just another fractional CFO. We’re creating your data-to-decision system—AI infrastructure + data insights + financial strategy + expert advice—that consistently empowers small business entrepreneurs with clarity, confidence, and growth readiness. We also cover end-to-end accounting.

Your Current Strategy

Once you take control

- It appears totally fine, but there is unlocked potential

- Was built on strong intuition, but lacks the data and mathematical framework to take the next giant leap

- Data is coming in from many sources, but it doesn’t tell you directly how each action impacts your wealth

- You struggle to identify the key areas to focus that will produce the highest ROI

- You are leaving money on the table via opportunities you can’t dechipher to cut costs and increase revenue

- For every action you take you can understand the direct cause and effect of it’s impact on your wealth

- You can test your strategies before putting any money down to understand the metrics you need to hit to make it profitable

- You can identify the most sensitive variables in your business, and use data and AI to improve them

- You unlock every piece of potential to maximize your profits and your personal wealth

- You unlock every piece of potential to maximize your profits and your personal wealth

What’s Holding Small Businesses Back?

Something is limiting their growth, and they don’t know what it is. They want to double or triple their profits—or more. However, the answer lies in a black box of information that they can’t yet identify, let alone open.

That black box is data. It needs to be collected properly, analyzed, and visualized in order to use it effectively. Once opened, it can be analyzed using AI tools and used in a financial model to help you navigate running your business profitably.

Without access to this information small business owners are flying without a map based on gut instinct. Your data, AI natural language processing, a bottom-up financial model, and expert advisor combines to give you GPS-like advice.

Why Most Small Businesses Fail

Statistics show that almost 20% of businesses fail in their first year, and almost 50% fail before reaching five years. Among these, 29% run out of cash, and 23% fail due to poor management.

In business, cash is king, and the better you understand what drives your cash flow, the greater your rewards and the lower your risks will be.

Understanding your cash flow in real time as well as what drives those cash flows allows you to focus on the impactful variables and manage your business in a way that makes your business not only survive, but thrive.

Why Our Clients Are Always Able To Grow Their Businesses

At FSA, we build fully integrated tools using AI data analysis, finance, and accounting techniques and have professional advisors to help our clients feel confident that they are making informed decisions that will lead to growing profitable businesses.

Everything we do is tailored to your specific challenges and vision. We collect your data to be analyzed using AI natural language processing. Your financial model is built entirely around your story and fed by your data. Your advisor uses these tools to help you make sense of everything.

Our clients get the clarity they need to confidently and profitably grow their business.

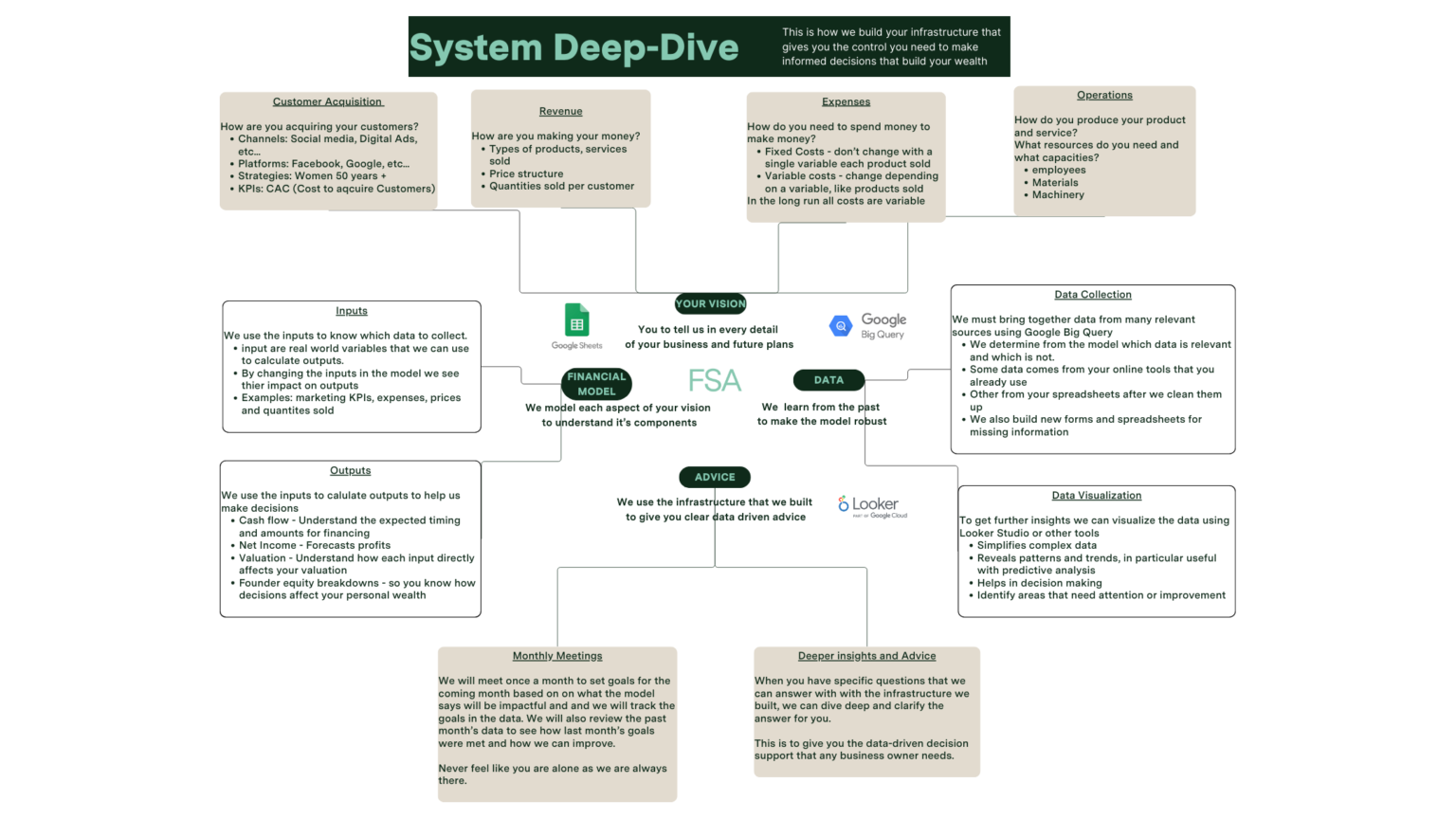

Our Mechanism For Driving Success

We do things differently than most fractional CFO companies by being AI first in terms of data insights and by using the bottom-up financial model approach. This allows you to determine how each variable in your business directly impacts your cash flow, so that that you can make the most profitable decision.

We don’t just analyze data, we make a direct link between how your actions are impacting the money in your pocket and use AI insights to find ways how to improve those actions and advise you on the objectively best strategies.

FSA is a one-stop shop that combines the functions of a CFO, data analysts, and end-to-end financial accounting for small businesses. Our advisors guide you with clear insights, empowering you to make confident, data-driven choices to maximize your wealth.

How It Works

Who Is This For?

Our services are designed for:

Small business owners with than 10 – 50 employees.

Entrepreneurs eager to grow their businesses.

Owners looking to improve cash flow and profitability.

Founders overwhelmed by the numbers and seeking clarity.

If you’re committed to scaling your business, FSA can help you achieve your goals.

Testimonials

About us

I am Andrew Geller, CEO and Founder of FSA. Throughout my entrepreneurial journey and client engagements, I have encountered numerous challenges that small businesses face.

In my first startup, I raised funds from family and friends but struggled to show them how I’d deliver returns. This frustration led me to develop data & financial tools to better understand my company’s core mechanics. These tools transformed my business, turning it cash-flow positive—and I realized they could benefit other businesses too.

Large companies rely on CFOs and data analysts to drive growth. As a fractional CFO, I’ve made it my mission to create accessible tools that empower small business owners to achieve the same success.

FSA Custom Packages

All Packages Include A Professional Advisor

Data Organization & Insights

We build your system for collecting data so that it can be easily analyzed using AI and expanded upon to build your dashboards according to the insights you need. We customize every step towawrds your goals. This data is used in your financial projections.

Financial Model Construction & Maintenance

We build your custom model and integrate it with your data in order to show you a forecast each aspect of your business and relate each decision to your valuation as a whole. We update the model as your business grows.

End-to-End Financial Accounting

This is a full accounting service including bookkeeping, accounts payable management, accounts receivable management, bank reconciliation, vendor reconciliation until balance sheet. These are integrated with your financial model forecasts.

* Note: Each service package can be taken individually or combination

Frequently Asked Questions

We first need to collect your data into a data warehouse. Next we use an AI software that allows us to ask questions of specifically your data using natural language processing as if it were, for example, ChatGPT.

If you want to maximize your wealth, you must understand how your actions affect your cash flow to make the best decisions. This system is the objective way to do this.

You can plan clearly your goals in the financial model and have the data and an advisor to keep you on track to your goals.

A CFO is a a Chief Financial Officer which is in charge of deciding whether an action in the business is profitable or not. They help you make optimize how you money from what you do by organizing your data, modeling your cash flow forecasts, and doing your accounting to give you the information you need to make your business.

All large companies have one and they are expensive.

A fractional CFO is a way to give smaller companies access to this service outsourced and part time so it’s affordable.

The purpose of all this is to help you, the entrepreneur, put more money in your pocket from your business by giving you objective tools to make decisions that are more profitable.

Essentially, we want you to be wealthier than if you go it alone or are guided by your gut.

This system does your end-to-end financial accounting, organizes and cleans your data collection from every source, visulalizes and analyzes that data, and then makes sense of the the results in terms of cash flow projections using the financial model to show you how to make wealth maximizing decisions.

The key performance indicator that this system attempts to improve is your business’ overall valuation and your wealth.

You will have a dashboard built in Looker Studio that displays the real time data visualizations, a bottom-up strategy focused financial model in google sheets, access to financial reporting documents, and a live advisor on call to help you plan your growth and answer questions.

Reports and dother documents can be created upon request.

Depending on your business’ complexity, it can take up to 3 months for the building phase, in which we get to know your business, build you a custom system to collect your data and move it to a central database, build you dashboards that visualize the data and a finacial model to analyze your data, and a process for your financial accounting.

Once built, the ongoing phase consists of a meeting once a month with an advisor to set goals for next month and analyze goals and tasks from the previous month. There are also a number of hours included each month for updates, modeling, building and updating infrastructure, and reports and advice.

Any entrepreneur or prospective entrepreneur that wants to best take advantage of quantitative analysis in their business and to give them objective decision support their gut feelings. This is most valuable for growing small businesses.

We are like your accountants on steroids.

Accounting and data deal with the past and present, finance deals with the future. It’s the future where your strategy and growth lies. We use the numbers from your accounting in your forecasts for to guide your growth strategy.

Accounting alone can’t account for your vision of how you plan to expand your business then strategize your cash flow to get there based on objective data. Our package with be your guide to reaching your goals.

It is often quite helpful to work with founders who have a financial background because in the end, it is financial concepts we are trying to communicate and the more familiar you are with them the more you will get out of the knowledge.

The entire system spans many disciplines in data and financial areas, giving you a professional product and an advisor to give an objective opinion. Even if you have all theh knowledge, we can probably do the work at a more effective cost to you doing it yourself.

Lastly, having an advisor with all the tools available to them to bounce ideas off of can be a great gut check for someone with a small to large background in finance.

Prices are made to be affordable for small business owners.

We work a set monthly fee for minimum a 12 month contract. Like a part-time outsourced employee.

Prices differ based on the complexitiy of your business.

For this set monthly fee you get all your infrastucture built, a monthly meeting, and a number of hours for extra data or finance work per month. Per hour charges apply if you need more time based on discussions of needs.

Set up a time to chat in our calendar and we can get started as soon as possible.